- Argentina(Español)

- Österreich (Deutsch)

- Belgium(English)

- Belgique (Français)

- België(Nederlands)

- Brasil (Português)

- Canada(English)

- Canada (Français)

- Chile(Español)

- (Chinese)

- Colombia(Español)

- Czechia(Czech)

- Denmark(Danish)

- República dominicana(Español)

- France (Français)

- Deutschland (Deutsch)

- Hungary(Hungarian)

- Italia(Italiano)

- 日本(日本語)

- Kazakhstan(Kazakh)

- Kazakhstan(Russian)

- Luxembourg(Français)

- Mexico(Español)

- (Français)

- Nederland(Nederlands)

- Panamá(Español)

- Perú(Español)

- Poland(Polish)

- Portugal (Português)

- Puerto Rico(Español)

- Romania(Romanian)

- Slovakia(Slovak)

- España (Español)

- Taiwan(Chinese)

- (Français)

- Turkey(Turkish)

- Ukraine(Ukrainian)

- United States(English)

- Uruguay(Español)

- Venezuela(Español)

Accelerating globalisation and digitisation have reinvented the transportation and logistics industry.

Although technological innovations have created new opportunities for growth, they have also disrupted the competitive landscape. Companies must now adapt to the increased potential for cyberattacks, litigation, changing regulations, emergence of new products and services, and heightened competition from start-ups and other recent entrants.

Labour, fuel, and other costs are also increasing at the same time that insurance prices are increasingly volatile. This puts added pressure on transportation companies to control costs, while also managing their dynamic risks.

Our global Marsh team of over 500 transportation specialists offers the capital and risk expertise that can help your business better understand, prioritise, and manage these risks. Through our consultative approach, we leverage data and analytics to help you effectively manage your total cost of risk, keep up with industry standards, and maintain a competitive edge.

Related insights

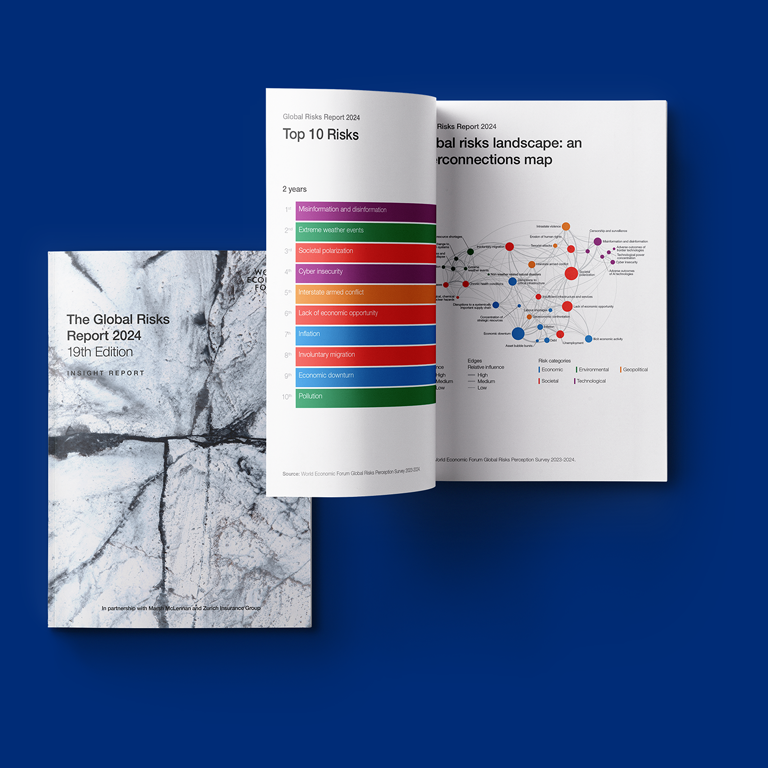

Report

Global Risks

10/01/2024

FAQs

Transportation insurance offers coverage of the insured's property while it’s in transit from one location to another. Some types of insurance coverage companies should consider when creating a risk management plan include:

- Cyber insurance: This provides coverage in the event of a loss from a cyberattack and benefits and terms will vary depending on the policy purchased.

- General liability insurance: This protects against property damage or injury claims made by a third party.

- Workers' compensation insurance: If your employees become ill or injured during a work-related incident, this can help cover any financial consequences. Depending on the type of work being performed, workers’ compensation is often mandatory in most US states. Similar insurance may be available or required in other countries.

- Property insurance: This covers recovery costs in the event of loss or damage to physical property, including vehicles, offices, or inventory, from a fire, storm, or other causes.

The most effective approach to risk management within the transportation industry will require your company to have both general coverage, such as the examples above, as well as specific policies tailored to the type of cargo you move and whether you transport people.

The following are the types of insurance coverage that companies with fleets should have:

- Bodily injury: This can afford coverage in the event of injuries or death associated with an accident for which your business is held responsible. This can also include coverage for potential legal costs.

- Property damage liability: If one of your vehicles or drivers damages another person’s property, this type of policy will typically cover the cost of repairs.

- Combined single limit (CSL) coverage: This type of policy provides coverage in the event that both bodily injury and property damage occur in a single incident.

- Cyber insurance: This type of policy can provide coverage in the event of a cyberattack.

Fleet insurance requirements are focused on liability. However, depending on your particular day-to-day operations, your business may also want to consider physical damage, uninsured motorists, and collision coverage.

Transportation insurance offers coverage of the insured's property while it’s in transit from one location to another. Some types of insurance coverage companies should consider when creating a risk management plan include:

- Cyber insurance: This provides coverage in the event of a loss from a cyberattack and benefits and terms will vary depending on the policy purchased.

- General liability insurance: This protects against property damage or injury claims made by a third party.

- Workers' compensation insurance: If your employees become ill or injured during a work-related incident, this can help cover any financial consequences. Depending on the type of work being performed, workers’ compensation is often mandatory in most US states. Similar insurance may be available or required in other countries.

- Property insurance: This covers recovery costs in the event of loss or damage to physical property, including vehicles, offices, or inventory, from a fire, storm, or other causes.

The most effective approach to risk management within the transportation industry will require your company to have both general coverage, such as the examples above, as well as specific policies tailored to the type of cargo you move and whether you transport people.

The following are the types of insurance coverage that companies with fleets should have:

- Bodily injury: This can afford coverage in the event of injuries or death associated with an accident for which your business is held responsible. This can also include coverage for potential legal costs.

- Property damage liability: If one of your vehicles or drivers damages another person’s property, this type of policy will typically cover the cost of repairs.

- Combined single limit (CSL) coverage: This type of policy provides coverage in the event that both bodily injury and property damage occur in a single incident.

- Cyber insurance: This type of policy can provide coverage in the event of a cyberattack.

Fleet insurance requirements are focused on liability. However, depending on your particular day-to-day operations, your business may also want to consider physical damage, uninsured motorists, and collision coverage.

At Marsh, we can help you reduce your total cost of risk through the development and implementation of customised fleet management programs aimed at improving safety performance, claims results, and negotiating strength in a complex insurance marketplace.