Ben Crowther

Head of Strategic Risk, Marsh Advisory, Pacific

Organisations today are facing increasingly complex and often rapidly evolving risks from a range of sources. If not controlled, these risks could present financial damage and volatility to an organisation’s business cycle.

Now more than ever, as demonstrated by COVID-19, the effective management of risk and resilience is fundamental to the success of an organisation, however, it is also imperative that the purchase of insurance is fully aligned to these management activities.

Organisations need to review, improve, and embed all areas of risk management to inform the principles of insurance program design.

Risk profiles, appetite for risk, controls, and governance need to be re-evaluated in light of interconnected businesses and the fragility of economies to global risks. Agile and lean operational practices may have insufficient spare capacity and reserves for rapidly evolving risks and crises.

Demand for greater governance and transparency has grown due to links between societal and business risk. Traditional ERM often lacks quantitative elements in risk and scenario analysis, and control planning. Risk practices can often be siloed in large companies, whereas risk is multi-dimensional in its causes, consequences, and controls.

Industries are rapidly changing with greater emphasis on integration of strategy, operations, and financial practices. Significant improvements can be gained quickly through a digital data driven approach to risk and insurance. Insurance can be the most effective way to transfer financial risk and protect the balance sheet but needs to align with risk and resilience management.

An integrated approach takes the best practice from traditional ERM and combines it with a data-driven approach, quantitative analysis, and insurance expertise to optimise management and financing of risk.

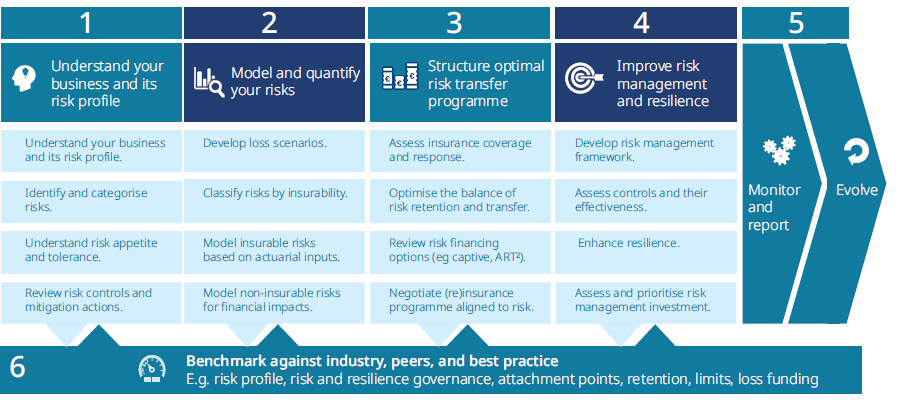

Step one: Connect an organisation’s strategy and business drivers to identify and analyse your risks systematically.

Step two: Project the operational and financial impact of key risks to inform decisions on control measures, retention, and transfer. Align risk controls with exposure priorities, identify additional risk mitigations to manage risk within appetite and providing organisational resilience.

Step three: Design an insurance program around threat exposure and appetite to ensure the most efficient use of capital.

Step four: Combine strategic, operational, and assurance best practices to integrate risk practices and achieve targets.

Step five: Road map from current state to future state to inform assurance and continuous improvement.

Need to talk? Contact us here.

Disclaimer: The information contained in this publication provides only a general overview of subjects covered, is not intended to be taken as advice regarding any individual situation, and should not be relied upon as such. The information contained herein is based on sources we believe reliable, but we make no representation or warranty as to its accuracy. Marsh shall have no obligation to update this publication and shall have no liability to you or any other party arising out of this publication or any matter contained herein. LCPA No. 21/149.

Head of Strategic Risk, Marsh Advisory, Pacific