- Argentina(Español)

- Österreich (Deutsch)

- (English)

- Belgique (Français)

- België(Nederlands)

- Brasil (Português)

- Canada(English)

- Canada (Français)

- Chile(Español)

- (Chinese)

- Colombia(Español)

- Czechia(Czech)

- Denmark(Danish)

- República dominicana(Español)

- France (Français)

- Deutschland (Deutsch)

- Hungary(Hungarian)

- Italia(Italiano)

- 日本(日本語)

- Kazakhstan(Kazakh)

- Kazakhstan(Russian)

- Luxembourg(Français)

- Mexico(Español)

- Maroc(Français)

- Nederland(Nederlands)

- Panamá(Español)

- Perú(Español)

- Poland(Polish)

- Portugal (Português)

- Puerto Rico(Español)

- Romania(Romanian)

- Slovakia(Slovak)

- España (Español)

- Taiwan(Chinese)

- Tunisie(Français)

- Turkey(Turkish)

- Ukraine(Ukrainian)

- United States(English)

- Uruguay(Español)

- Venezuela(Español)

2021 Q1

Global commercial insurance pricing up 18% in first quarter of 2021, Asia insurance pricing increased 8% year-over-year.

A proprietary measure of global commercial insurance premium pricing change at renewal, representing the world's major insurance markets and comprising nearly 90% of Marsh's premium. The quarter is the first to show a fall in the average rate of increase since the index reported the first rise in global rates in Q4 2017. It follows year-on-year average increases of 22% in the fourth quarter and 20% in the third quarter of 2020.

According to the index, increases across geographies moderated due to generally slower rate rises in property insurance and financial and professional lines. The UK, with a composite pricing increase of 35% (down from 44% in Q4 2020) and the Pacific region, with a 29% increase (down from 35% in Q4 2020) drove the global composite rate. The rate of increase in the US was 14% (down from 17%), in Pacific 29% (down from 35%), in Asia 8% (down from 11%), and in Latin America and the Caribbean 5% (down from 9%).

Among other findings, the survey noted

- Global property insurance pricing was up 15% on average, down from the 20% increase in the fourth quarter 2020; casualty pricing was up 6% on average, compared to a 7% increase in the prior quarter.

- Pricing in financial and professional lines had the highest rate of increase across the major insurance product categories, at 40%, compared to 45% in the previous quarter.

- Cyber insurance pricing diverged from the trend, with prices increasing in the first quarter by 35% in the US and 29% in the UK, driven by a rise in the frequency and severity of losses. In the previous quarter, cyber rates were 17% in the US and 26% in the UK.

As in other regions, pricing in Asia was driven by property insurance and financial and professional lines.

Property insurance pricing across Asia rose 10%, a moderation from the 16% increase in the fourth quarter of 2020.

- For clients across the region, the degree to which they engage international capacity broadly determined renewal outcomes, with sharper price increases coming from a greater reliance on international capacity.

- Clients with significant catastrophe (CAT) exposures and those requiring international capacity continued to experience pricing increases, albeit the pace of change slowed in the first quarter.

- Strikes, riots, and civil commotions (SRCC) coverage has been all but removed from property policies in Hong Kong; coverage is available in the standalone political violence or terrorism markets.

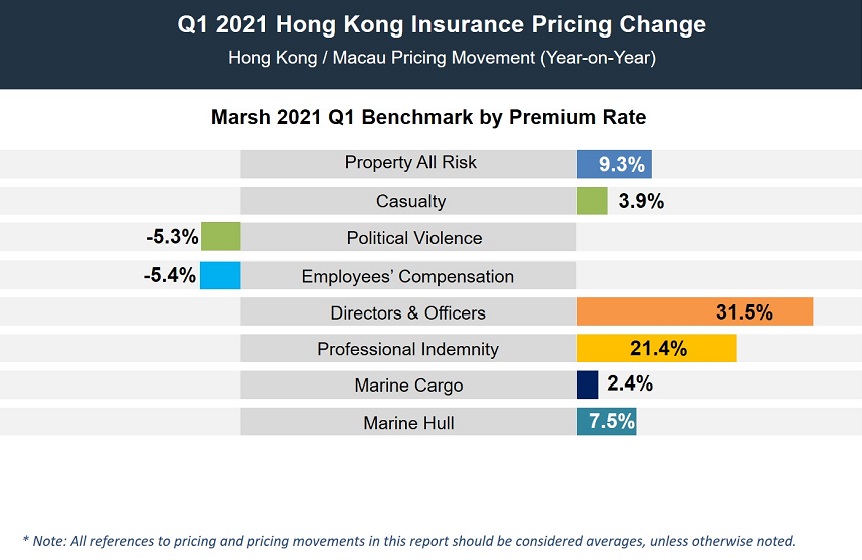

- For property whilst premium rates are still increasing around 10% on average in Hong Kong, this is lower than previous quarters. Global accounts are experiencing higher rate increases than local accounts. For local risks, there is more competition and a portfolio approach to underwriting.

- Political Violence is also experiencing rate reductions since social unrest dissipated in Hong Kong.

Casualty insurance pricing in Asia remained generally flat, as it has for more than three years.

- Japan, Korea, and other countries experienced pricing challenges at renewal related to product recall-driven losses, combined with reduced insurer appetite.

- In Hong Kong, there are modest rate increases particularly on excess layers that have been very competitive.

Financial and professional lines pricing across Asia rose 23%, the largest increase observed in several years and the eighth consecutive quarter of increase.

- The cyber insurance market in Asia faced considerable upward pressure on rates and deductibles, with a reduction in capacity and narrowing of key coverages. The premium increase was up to 50%, on average, across all industries, as underwriters are scrutinizing risks due to market concerns with ransomware and overall aggregation.

- Vietnam remains a challenging market, with average increases of 15% in rates and deductibles.

- Philippines experienced a reduction in capacity, increased deductibles and premiums, and difficult discussions regarding exclusions, extensions, and a longer turnaround on claims.

- India experienced a major rate of increase in technology professional indemnity insurance premiums — 25% on average and 100% for accounts with claims.

- The financial and professional lines market in Japan did not change significantly since the fourth quarter of 2020, with the exception of the cyber market.

- The FINPRO classes of Directors & Officers (D&O), Professional Indemnity (PI), cyber and crime remain the most challenging in Hong Kong. There is limited market available with capacity from the global insurers. Historically very low premium rates, wide coverage coupled with adverse loss trends globally and increasing concern on exposure are forcing up the pricing sharply.

For Employee Compensation (EC) business in Hong Kong, we can see more competition in the market following a return to profit for insurers in 2020, resulting in premium rate reductions of 5.4%.

Marine business in Hong Kong is still experiencing premium rate increases following some high profile losses.